401(k) plans hold $6.2 trillion in assets as of December 31, 2019, on behalf of more than 58 million active participants and millions of former employees and retirees. Savings rolled over from 401(k)s and other employer plans also account for about half of the $11 trillion held in individual retirement account assets as of December 31, 2019. The plan can be a powerful tool in promoting financial security in retirement. They are a valuable option for businesses considering a retirement plan, providing benefits to employees and their employers.

Plan sponsors, advisers and providers are always recommending defined contribution (DC) plan participants defer enough of their salaries into the plan to receive the full employer match contribution. In order to make sure participants are maximizing their retirement savings, plan sponsors may offer a true-up match.

A true-up contribution is an employer contribution made to a participant’s account when the actual, total employer match contributed on a per pay period basis is less than the calculated employer match on a year to date basis. This feature permits participants to receive employer match they might otherwise have missed, either because of front-loading or spreading out contributions unevenly during the year. According to a 2017 survey by Deloitte, approx 54% of 401k plans offered a “true-up” provision compared to 45% in 2015.

Employers can handle true-ups differently. Many wait until after the plan year has ended before they process true-up payments, while others make true-up matching contributions throughout the year, per paycheck, until a participant reaches the IRS maximum contribution limit. True-up review is usually performed for the prior plan year to ensure that the amount of employer matching contributions is grossed up to a maximum allowable benefit per the plan document. For instance, if an employee maxes out on the participant portion due to bonus or supplemental pay, he or she could miss out on the employer match for several months. A true-up corrects this imbalance.

Elective deferrals and investment gains are not currently taxed and enjoy tax deferral until distribution.

Helps employees in building net worth and financial independence for their retirement years.

Employees can grow their savings in a tax-deferred account and multiply their savings by way of the employer’s matched dollars.

Employers offer benefit programs such as 401k matching or true up provisions to help employees feel valued and build financial security for themselves and their families through tax-advantaged savings.

Very few companies perform true-up reviews every quarter while others wait until the end of each year. Performing quarterly true-up could result in financial and non-financial benefits. Some of them include

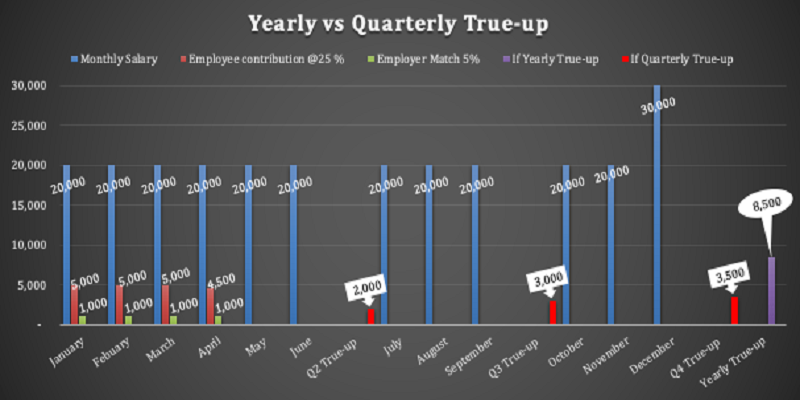

With the employer providing 100% match up to 5%, a quick illustration should help clarify the importance of quarterly True-up contributions:

Therefore, if the employee maxes out in April 2020, he does not receive a matching contribution for the rest of the year.

Employee receives $8,500 of true-up contribution during the next financial year. However the participant may have to be employed during the last financial year in order to receive the benefit

Employee receives $2,000 in Q2 2020, $3,000 in Q3 2020 and $3,500 in Q4 2020. The contribution amount is spread throughtout the year which benfefits both the employee and employer

Employee missed out on $8,500 of true-up contribution

It is advisable that employees perform a background review on the company policies and true-up provisions w.r.t employee 401(k) benefits. Unfortunately, not all plans are straightforward, and it requires knowledgeable management to take full advantage of the employee benefits offered. In terms of employee-friendliness, the best practices for employer match go in this order, from least friendly to most friendly:

Contact us for the best virtual accounting and bookkeeping services